chief’s designated bank deposit accounts

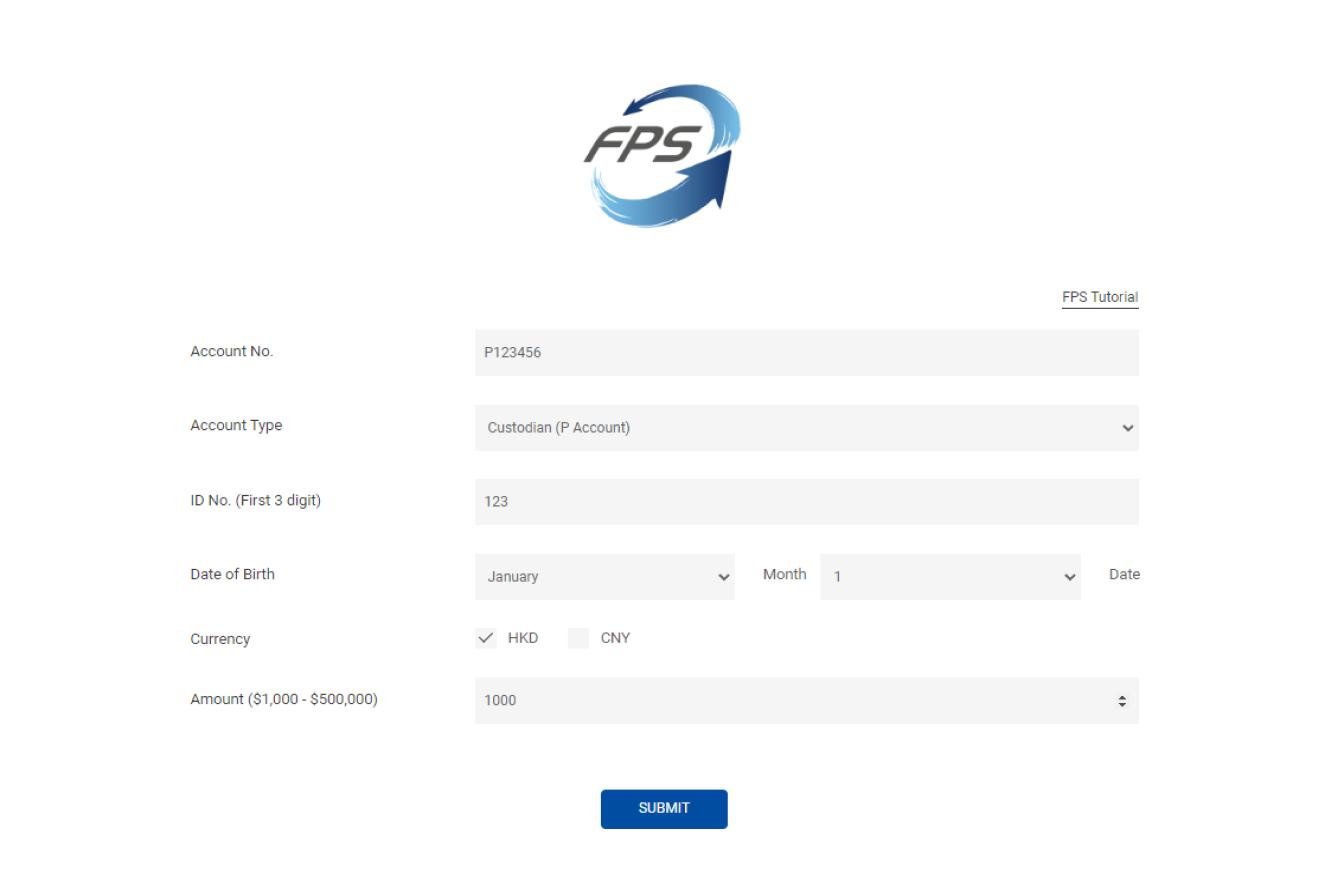

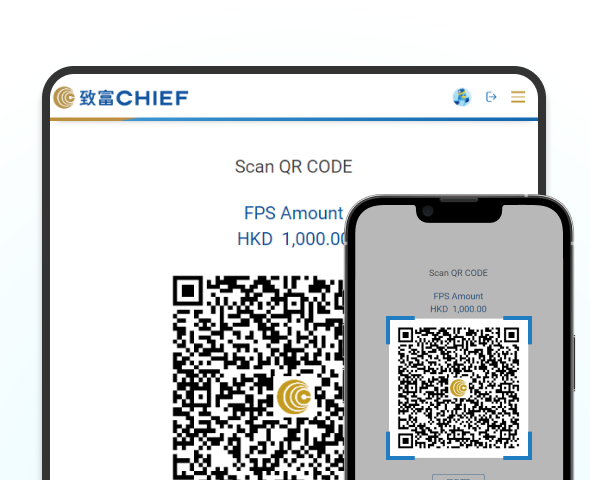

fps

|

fps id

|

8785271

|

|

email

|

cs@chiefgroup.com.hk

|

chief's bank accounts

chief securities limited

chief commodities limited

|

cut-offs before 17:00 each trading day |

deposit account hong kong stock / global stock / stock option account |

| hkd | multi-currencies | |

|---|---|---|

|

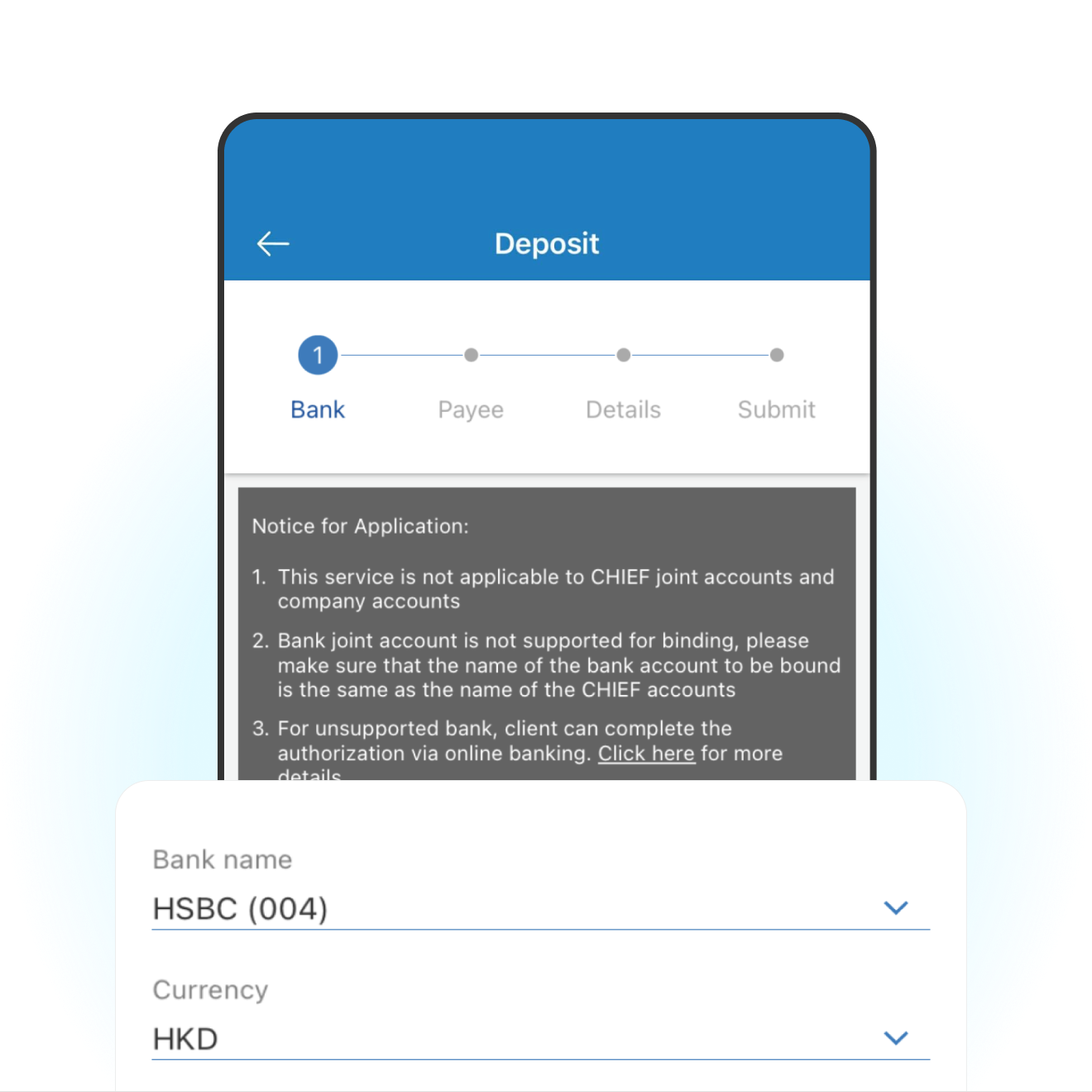

hsbc

|

400-273900-292

|

741-033393-838

|

|

hang sang bank

|

383-017175-668

|

239-560576-883

|

|

bank of china (hk)

|

070-932-1-001950-0

|

012-875-9-244782-6

|

|

chong hing bank

|

256-10-266611-2

* stock option cut-offs: before 15:45 each trading day |

|

cut-offs before 16:30 each trading day |

deposit account hong kong futures / global futures account |

| hkd | multi-currencies | |

|---|---|---|

|

hsbc

|

600-638282-002

|

502-693450-201

(usd)

|

|

848-201349-209

(rmb)

|

||

|

808-169734-275

(eur)

|

||

|

808-169734-278

(jpy)

|

||

|

808-169734-276

(gbp)

|

||

|

bank of china (hk)

|

012-875-0-040383-4

|

012-875-0-801657-3

(usd)

|

|

012-875-0-602238-5

(rmb)

|

||

|

012-875-9-240576-1

(usd / eur / jpy / gbp)

|